Skin, Scale, and Star Power

How celebrity beauty brands became serious business—and what’s coming next

From Lip Kits to LTV: The First Wave of Celebrity Beauty (2015–2019)

Before Rhode glaze, there was Kylie.

Kylie Cosmetics wasn’t the first celebrity beauty brand, but it was the first to behave like a startup—and scale like one too. When the brand dropped its initial $29 “lip kits” in late 2015, they sold out in under a minute. By 2016, the brand hit $300 million in revenue with just seven full-time employees and one contract manufacturer (a detail still debated to this day). By 2019, it had caught the attention of Coty, which acquired a 51% stake for $600 million — valuing the brand at $1.2 billion.

The brand struggled post-acquisition. Revenue reportedly dropped by double digits soon after the deal, and investors began to question whether Kylie’s personal brand could drive sustained demand—or whether the hype had simply peaked.

The possible issue? Kylie Cosmetics was more licensing play than business, Which worked for a digital drop model, but not for long-term value creation.

Still, the lesson for investors was clear: a name might drive the first $50M in revenue, but real business infrastructure drives the next $500M.

Which is why the second wave—Rhode, Rare, Fenty, and r.e.m.—looks very different. They’re vertically integrated, professionally operated, and built with an eye on lifetime value, not just first-day sellouts.

The New Playbook: Celebrity Brands as Cultural Flywheels

The first wave of celebrity beauty was about lending a name to a product.

In the 2nd wave The founder is the product, the platform, and the proof of concept.

One Category, Many Plays

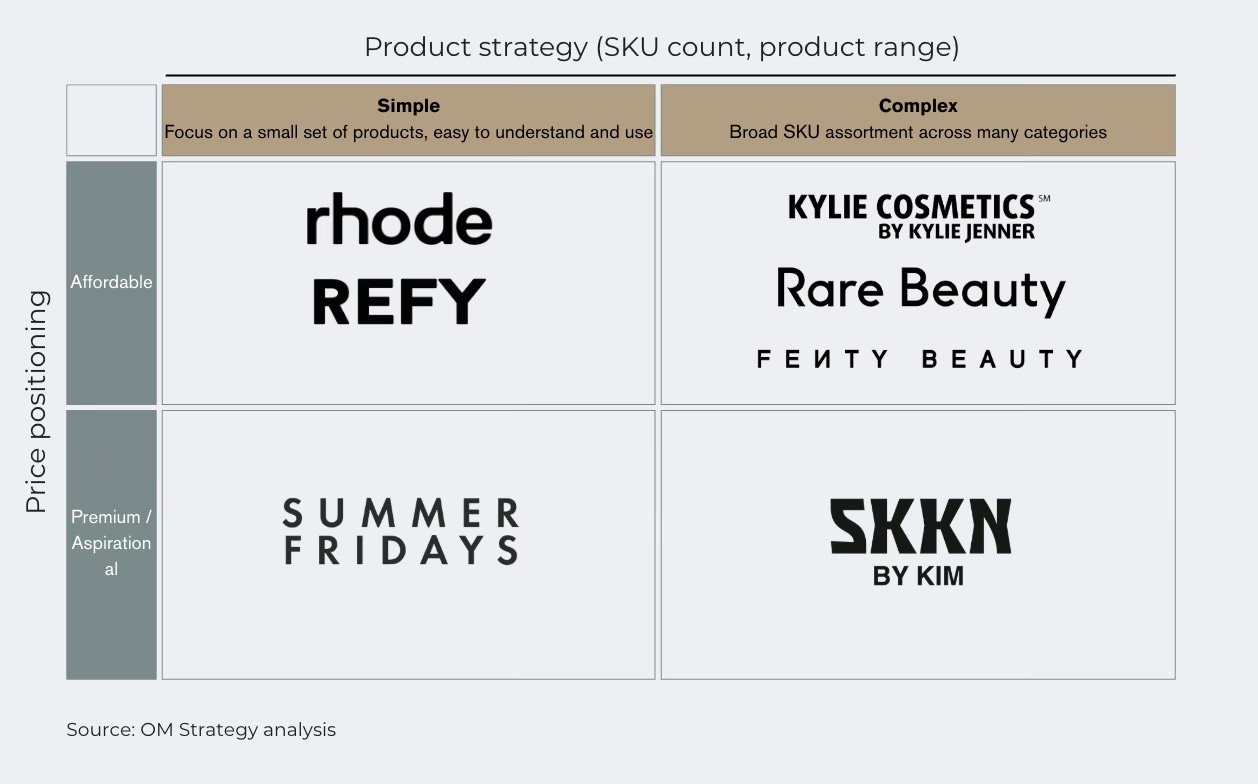

While their founders all bring cultural capital, the business playbooks vary wildly.

Some lean minimalist and skin-first. Others go maximal and makeup-heavy. Some want to feel prestige. Others sell little treats.

This isn’t a one-size-fits-all space. It’s a category where founder DNA shapes product logic

Trend-Led Strategy, Not Trend-Chasing

Zooming out, three macro themes drive today’s most successful launches:

Skin > Color

Barrier health is the new glam. Modern young consumers want good light, good habits, good skin. Brands like Rhode win by tapping into this skincare-first mindset.“Little Treat” Pricing

Most celebrity beauty SKUs live between $16–$38—premium enough to feel like a gift, affordable enough to repeat.Tight Assortment, Seasonal Drop Model

Rhode launched with three products. Rare started with just over a dozen. This scarcity leads to faster sell-through, stronger hero SKUs, and lower inventory drag.

Content Is the Marketing Plan

These brands don’t need paid ads.

Every GRWM video, every bathroom shelfie, every blurry backstage selfie is part of the story.

Hailey reportedly generated $400 million in earned media value (EMV) for Rhode — effectively, a marketing budget the company didn’t have to spend

What This Creates: A Flywheel You Can’t Pay For

Founder-led content drives cultural momentum.

Cultural momentum drives product demand.

Product demand drives community engagement.

And community engagement generates even more content.

Which brings us here: Lower CAC. Higher LTV. Faster feedback loops.

It’s about founders who’ve built visual worlds and emotional resonance at scale—and turned that into serious consumer infrastructure.

What Comes Next - Predictions

Increased Strategic Acquisitions by Fashion and Luxury Groups

LVMH’s partnership with Fenty is already a blueprint. With proven traction and strong gross margins, celebrity-led beauty brands are now viable acquisition targets for:

Luxury conglomerates seeking Gen Z audience reach (e.g. Kering, Richemont, Puig).

Consumer holding companies like Estée Lauder, Coty looking to diversify their portfolios.

Private equity firms aiming for digitally native, brand-led growth assets.

The more operationally mature these brands become—especially in global logistics, inventory management, and multi-channel retail—the more attractive they’ll be for institutional buyers.

Expansion into Asia via Strategic Capital

Asia is the next frontier for celebrity beauty. According to market data, South Korea has the highest per capita luxury spend in the world, and Gen Z consumers in China and Japan are highly responsive to celebrity marketing and digital storytelling.

We can anticipate:

Launches and activations tailored for Douyin, Weibo, and Kakao platforms.

Regional partnerships with K-beauty and J-beauty.

Equity investment from Asian entertainment and media companies (similar to HYBE backing r.e.m. beauty).

This is not just a distribution play. It’s about adapting brand storytelling and product strategy for regional tastes—especially skincare-first routines and wellness integration.

Vertical Expansion into Adjacent Categories (Body, Hair, Wellness)

Once a celebrity brand has credibility in one beauty subcategory, expanding into adjacent verticals is a natural and often margin-enhancing next step.

Examples of how this might play out:

Rhode enters body care or SPF (already hinted at with Peptide Glazing Fluid used on shoulders/arms in social).

Rare Beauty launches scent or wellness SKUs (e.g. aromatherapy or anxiety-reducing formats that match its emotional brand tone).

Fenty expands further into hair and fragrance (already underway).

Beauty brands with high repeat rates and strong emotional resonance are well-positioned to cross-sell. This also builds toward portfolio depth, making a brand more attractive for acquisition or licensing.

Shift Toward Omnichannel, But on Their Terms

While these brands have thrived in DTC and social-first ecosystems, retail visibility still matters—especially internationally. But rather than rushing to wholesale, many are selectively entering retail.

Expected moves:

More selective retail expansion (e.g. Rhode moving into Sephora in 2025, Rare expanding into global Sephora network).

Use of flagship pop-ups and short-term retail experiences to test markets before committing to permanent doors.

Owned physical retail might emerge for top-tier brands—especially as the audience ages and expects more tactile touchpoints.

Physical retail improves discoverability and reach (especially in make-up), but must be balanced with brand control and unit economics. Celebrity brands might even dictate terms more than traditional DTC brands due to built-in demand.

Conclusion

The celebrity beauty playbook is maturing. What started as hype-driven, DTC-first launches is evolving into operationally solid, vertically integrated businesses. The lesson? Fame still helps — but without strong infrastructure, it doesn’t scale. And for investors, what once looked like a branding game now looks a lot more like a smart consumer growth strategy.